The Missing LINK of Tokenization

How Chainlink makes tokenized finance a practical reality

Finance is not, and has never been, a static concept.

For centuries, finance took a physical form, with transactions and asset ownership recorded on paper and trading taking place between humans in a physical location. The conduits of finance remained fundamentally unchanged until the mid-20th century when trading volumes on Wall Street grew so significant that brokerages were forced to adopt mainframe computers and convert the financial system into an electronic format just to keep up with the paperwork.

In an electronic format, financial transactions and asset ownership are digitized, but ultimately recorded across a fragmented collection of databases managed by different centralized intermediaries, particularly between different industries and asset classes. This database fragmentation necessitates constant and continuous reconciliation between institutions in order for each to maintain a consistent view of the assets and transactions relevant to them and their clients. These, often manual, processes naturally lead to human errors, increased costs, and settlement delays.

Furthermore, databases that record asset ownership are often disconnected from databases containing materially relevant information about assets, such as contractual agreements involving the asset (e.g., has the asset already been pledged as collateral) and key risk information needed to price the asset properly. Because no single database provides a complete picture of the state of an asset, information asymmetry arises between asset issuers and purchasers, typically favoring the issuer who has more information at hand.

This is the financial system we deal with today.

A fragmented collection of siloed databases, controlled by a never-ending series of rent-seeking intermediaries, for which it is effectively impossible for anyone to achieve a complete global view of the entire system.

The primary consequence of such an opaque, inefficient system is that its participants, including financial regulators, are unable to properly identify, measure, or mitigate systemic risks. The net result is an amplification of the destructive boom-and-bust cycles, where society ultimately pays the bill when bailouts are inevitably required. The 2008 financial crisis had no single root cause, but opacity around systemic exposure to toxic assets played a key role.

Tokenization embodies the belief that we can do better.

Tokenized Finance Was Always Inevitable

It’s easy to see tokenization as being a radical departure from the status quo of finance. But history shows that the real radical change was the aforementioned shift from a physical paper format to electronic digital format. Tokenization is simply an obvious, yet powerful optimization.

Practically speaking, tokenization is the consolidation of the global financial system and its fragmented collection of databases into a single shared network. In a tokenized financial system, blockchains serve as the golden source of truth for the state of any asset or agreement. These distributed ledgers not only record and verify asset ownership, but also serve as a programmable execution layer and immutable data storage layer.

Through this perspective, the value proposition of tokenization becomes clear:

Information asymmetries are eliminated as all participants have access to the same comprehensive datasets about assets at the same time as everyone else.

Expensive and error-prone database reconciliations are no longer necessary, as one only needs a copy of the shared public ledger to anchor their internal records, reducing costs for consumers.

Rent-seeking intermediaries lose their relevance as any contractual agreement involving an asset can be codified as an autonomous smart contract, with predefined triggers and outcomes executed exactly as written.

Multi-day settlement delays become a foreign concept as transactions finalize in less than a second via a shared ledger that is available 24/7/365, including during weekends, holidays, and maintenance periods.

End-to-end transaction costs are reduced as assets can be embedded with custom logic, from automatically distributing dividends to bond holders to automatic rebalancing of a fund when predefined valuation triggers are met.

Financial transactions that were previously impractical or too costly, such as micropayments and payment streams, become feasible for anyone and everyone on a global scale.

Entirely new categories of digitally-native asset classes can be created in the future that cannot be possibly foreseen today, derived from the unique attributes of blockchains and tokenization.

Tokenization is the superior way to represent assets.

While the benefits of tokenization are clear, the reality is that nothing is ever as simple as it seems. There are a number of key roadblocks that need to be first overcome in order for tokenized finance to achieve its full potential.

Roadblock #1: Blockchain Fragmentation

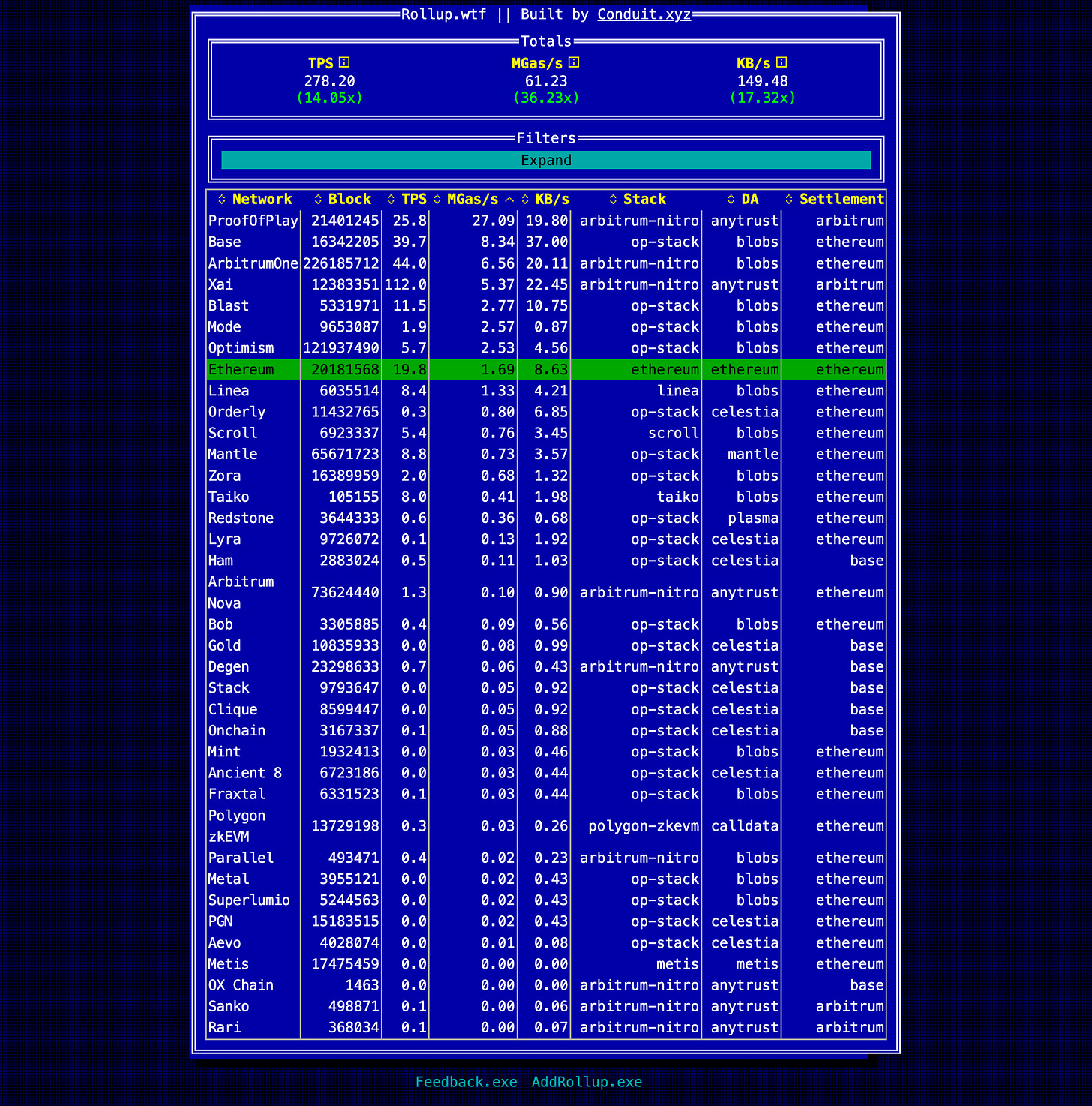

The idea that all the world’s financial transactions can be recorded on a single blockchain’s ledger is completely unrealistic. This stands from both a technical perspective—no single blockchain can scale to handle all the world’s transactions while maintaining the properties that make blockchains unique—and from a practical perspective—it’s extremely unlikely that everyone, including all institutions and nation states, will align on and agree to use the same blockchain.

Already today, there are hundreds of distinct public and private blockchain networks, each of which can be considered its own database silo given the lack of native interoperability. As the cost and complexity of launching a blockchain continues to trend towards zero (e.g., due to the proliferation of services such as rollup-as-a-service providers), it is extremely probable that the number of blockchains will continue to grow and multiply.

Is the fragmentation of the multi-chain ecosystem no different than the fragmentation of database silos in the existing financial system? Is the “single shared network” vision of tokenization thereby unachievable?

This is where cross-chain interoperability comes into play. By serving as a universal communication layer between distinct blockchain networks, protocols like Chainlink CCIP enable the multi-chain ecosystem to operate as if it were one unified network. Assets and data can seamlessly flow between different blockchain networks, just as easily as data packets are sent between servers in the existing Internet today.

For tokenized assets, cross-chain interoperability isn’t a nice-to-have, but rather a fundamental requirement. A tokenized asset that is restricted to one blockchain ledger means that the total addressable market for that asset is confined to that one chain environment—likely a small fraction of the total available liquidity that would be willing to purchase the asset.

Any such financial asset will be easily overshadowed by an equivalent product that is available cross-chain, given its superior accessibility and liquidity profile. From the perspective of an asset issuer, it makes little difference what underlying blockchain a counterparty wants to use, as long as they are willing to pay.

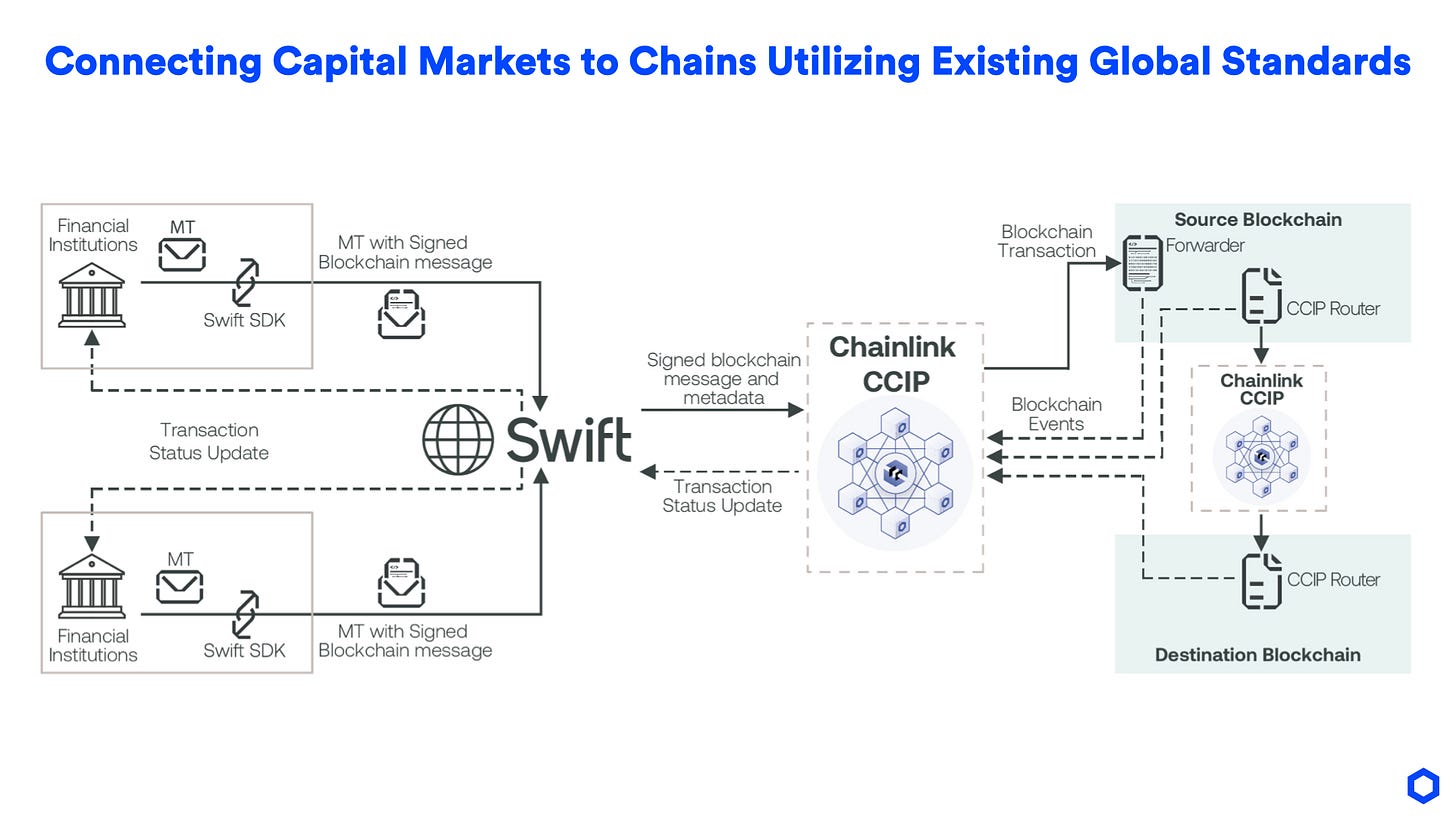

In addition to direct chain-to-chain interoperability, Chainlink CCIP also serves as a blockchain abstraction layer, enabling institutions to connect to any public/private blockchain using their existing backend infrastructure and established banking messaging standards. Rather than manually integrating with the hundreds of blockchains networks, institutions only need to integrate with CCIP once to access any blockchain environment their counterparties may operate on.

This blockchain abstraction capability was highlighted in an industry collaboration between Swift—the interbank messaging network used by 11,000 banks globally—Chainlink, and more than a dozen financial institutions and market infrastructures including DTCC, Euroclear, and Clearstream.

“The collaboration between Swift, Chainlink, and the financial community represents significant progress towards enabling interoperability between traditional financial systems and emerging blockchain networks … By leveraging existing Swift infrastructure and Chainlink CCIP, the collaboration demonstrated the ability to transfer tokenised value efficiently and securely across public and private blockchains, using standardised messaging formats and proven business processes.” — Swift

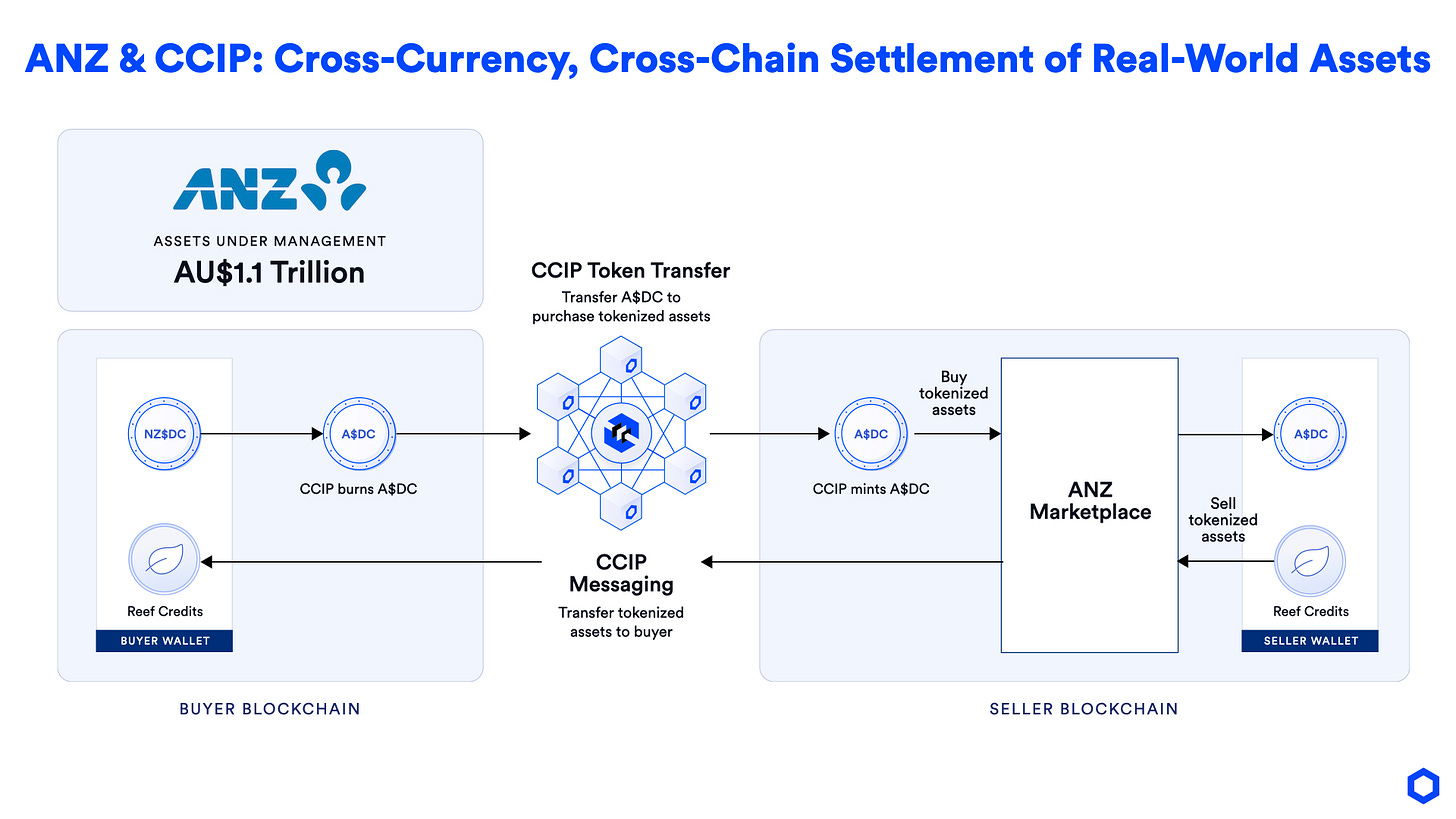

Cross-chain interoperability is also key to unlocking more advanced tokenized asset workflows such as cross-chain delivery vs payment (DvP)—a settlement process in which payment is made before or at the same time as the delivery of the purchased asset. In a recent collaboration, ANZ Bank—an Australian institutional bank with $1+ trillion AUM—demonstrated how Chainlink CCIP enabled the purchase of a tokenized carbon credit issued on one blockchain with ANZ-issued stablecoins issued on another blockchain.

Through a single transaction, enabled by CCIP’s Programmable Token Transfers, participants were able to complete a cross-border, cross-chain, and cross-currency DvP transaction involving multiple currencies and assets.

“We’re excited to drive financial innovation at ANZ by providing our clients with seamless access to tokenized assets through an easy-to-use platform. Chainlink CCIP played a key role in abstracting away the blockchain complexity of moving tokenized assets across different chains and ensuring atomic cross-chain DvP.” — Lee Ross, Technology Domain Lead, ANZ

Roadblock #2: Offchain Data Access

Eliminating information asymmetry via tokenization requires that all relevant data about an asset be recorded onchain and be accessible to all parties. However, blockchains do not natively have access to external data resources or the offchain systems where data originates.

If market participants still need to reference a fragmented collection of traditional databases to gather materially relevant information about assets, then the vision of blockchains being the “golden source of truth” will fail to materialize.

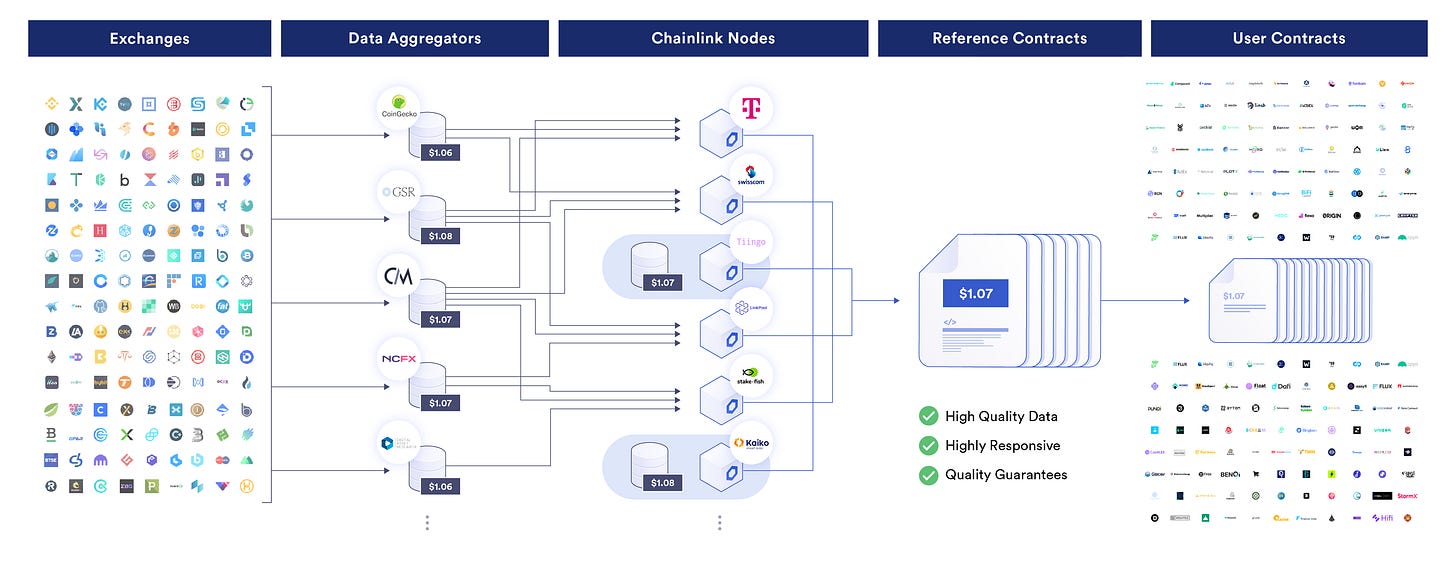

This blockchain oracle problem, as it’s commonly referred, is the key limitation of blockchains that Chainlink was originally built to solve. Since its launch on mainnet five years ago, Chainlink Data Feeds have become the standard for onchain financial market data. Securing over $60 billion in DeFi TVL at its peak and over $12 trillion in transaction volume, Chainlink Data Feeds prove not only can blockchains serve as a golden source of truth for onchain financial markets, but that the Chainlink oracle network model is well suited to bring any type of financial data onchain.

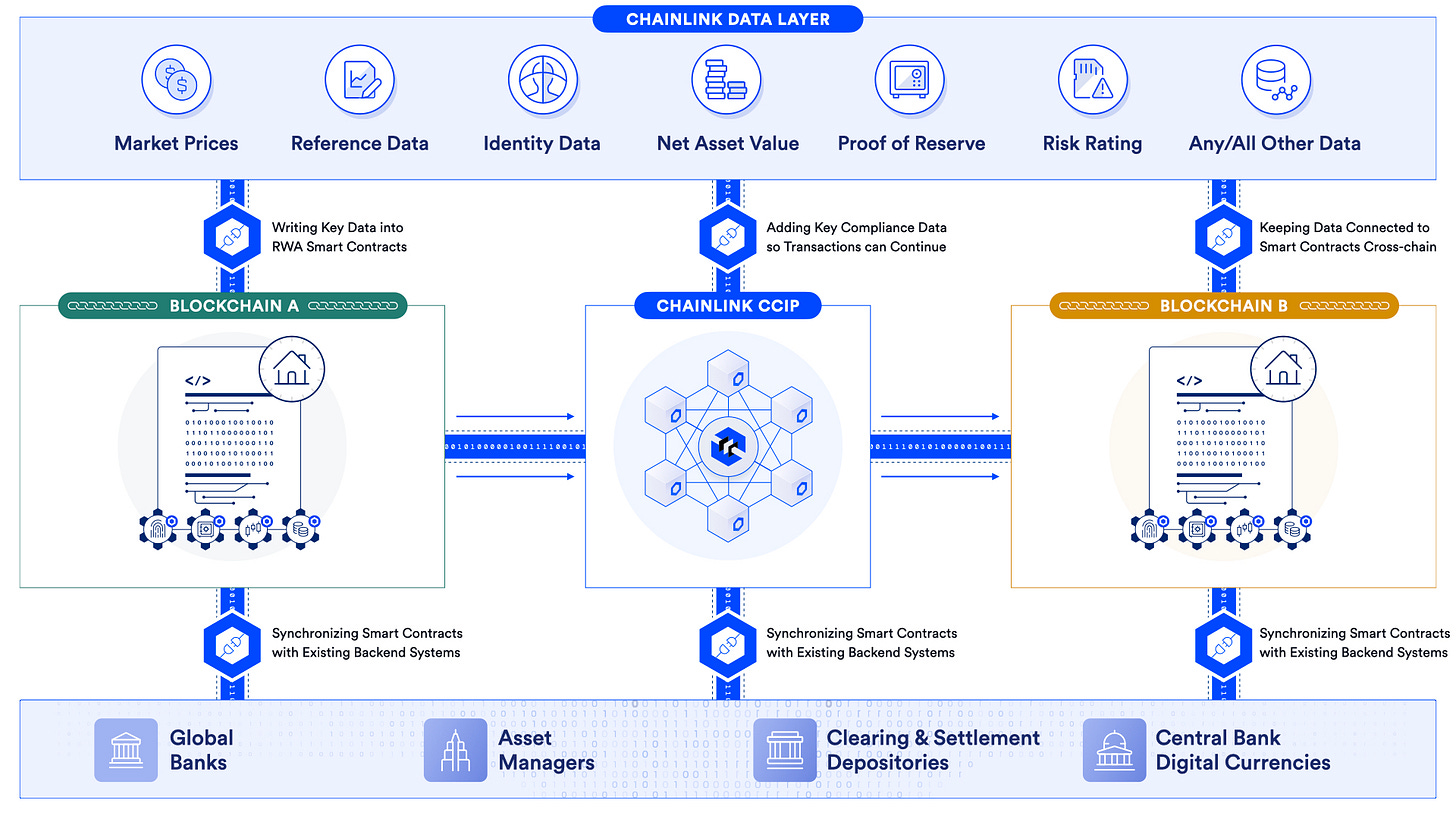

More specifically, Chainlink enables asset issuers to bring key data relevant to a particular asset onchain, including standing settlement instructions, corporate actions, proxy voting, dividends and interest, net asset values, and more. This data, once recorded onchain, can be referenced by any offchain market participant, as well as onchain financial protocols that execute predefined actions based upon these data inputs.

When combined with CCIP, onchain data can be transferred alongside a tokenized asset as it moves cross-chain, ensuring the asset continues to be updated with materially relevant information, even as it exchanges hands and moves across networks.

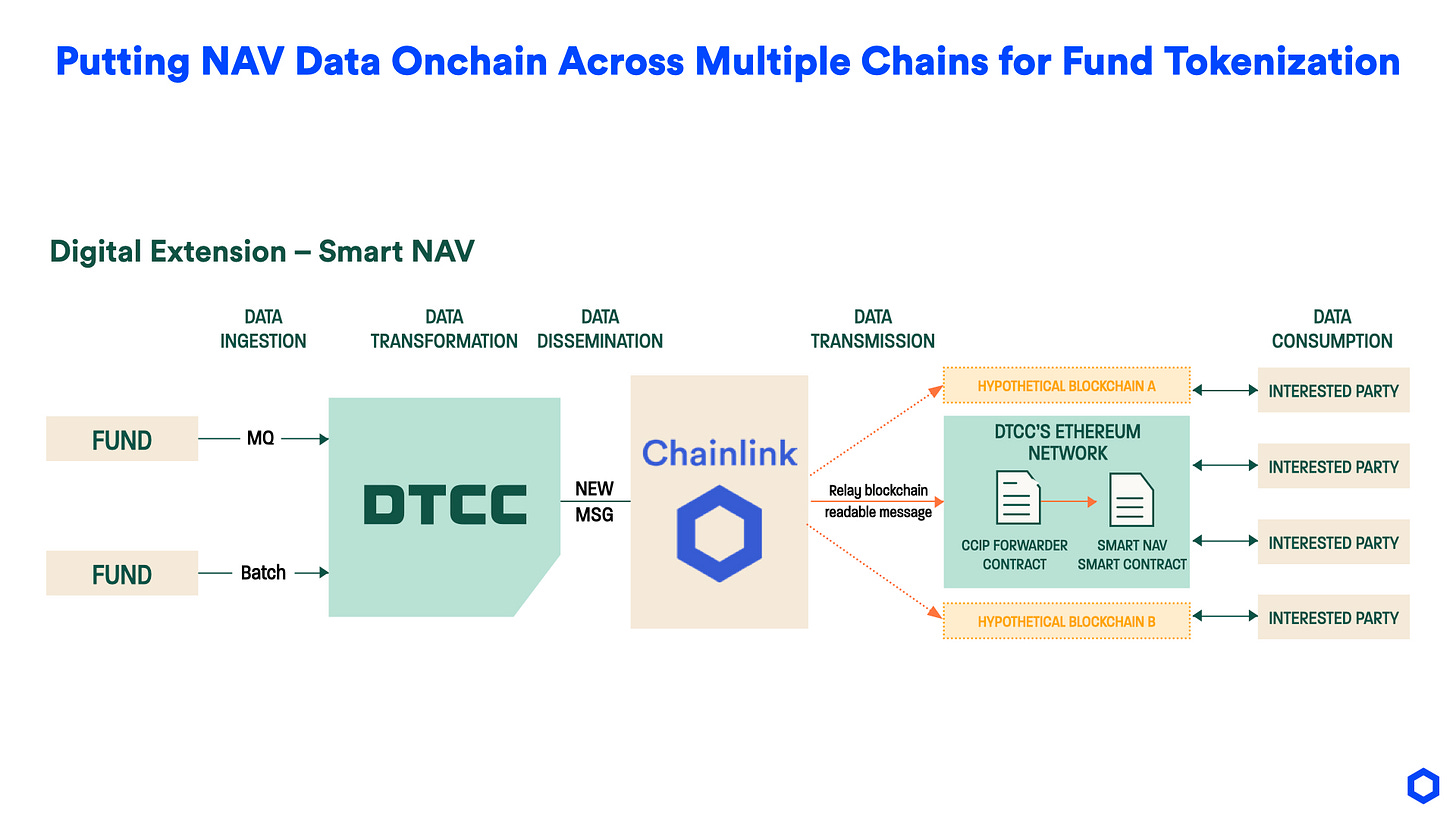

As a practical example of this onchain data connectivity, the Depository Trust & Clearing Corporation (DTCC)—the world's largest securities depository and primary infrastructure in the U.S. for clearing, settlement, and asset servicing—recently published the results of a Smart NAV pilot where Chainlink CCIP was used to deliver net asset value (NAV) data onchain to support the tokenization of mutual funds. In collaboration with 10 market participants, including JP Morgan, BNY Mellon, and Franklin Templeton, the DTCC and Chainlink proved the feasibility and industry value of delivering a blockchain-based price and rate dissemination solution.

“The Smart NAV pilot demonstrated CCIP’s ability to serve as an abstraction layer between DTCC and the potentially infinite number of blockchains we may need to integrate to at some point in the future. Rather than building bespoke connections, we were able to validate an approach where DTCC systems integrate to a single CCIP endpoint which can then relay the data to virtually any destination blockchain.” — DTCC

Chainlink as Essential Infrastructure for Tokenized Finance

The true value of Chainlink for tokenization is not just its cross-chain capabilities, its onchain data capabilities, or its blockchain abstraction capabilities, but the fact that it serves as a universal platform providing all of the services that a tokenized economy needs, but that blockchains alone do not provide.

Compared to combining a hodgepodge of solutions from across different single service vendors—each varying in quality, reliability, cost, and composability—adopting the Chainlink platform provides a future-proof solution for institutions where services can be seamlessly composed out-of-the-box.

Simply put, Chainlink makes tokenized finance a practical reality.

For more content, follow me on Twitter @ChainLinkGod and listen to The CLG Podcast on Spotify and YouTube.